How to add an outsourced semi-finished products to product assumptions?

Product card of outsourced semi-finished products

Production settings for a outsourced semi-finished products

Unit (unit conversion rates) for a outsourced semi-finished products

Storage rules settings for a outsourced semi-finished products

By-products settings for a outsourced semi-finished products

Other expenses (product-driven expenses)

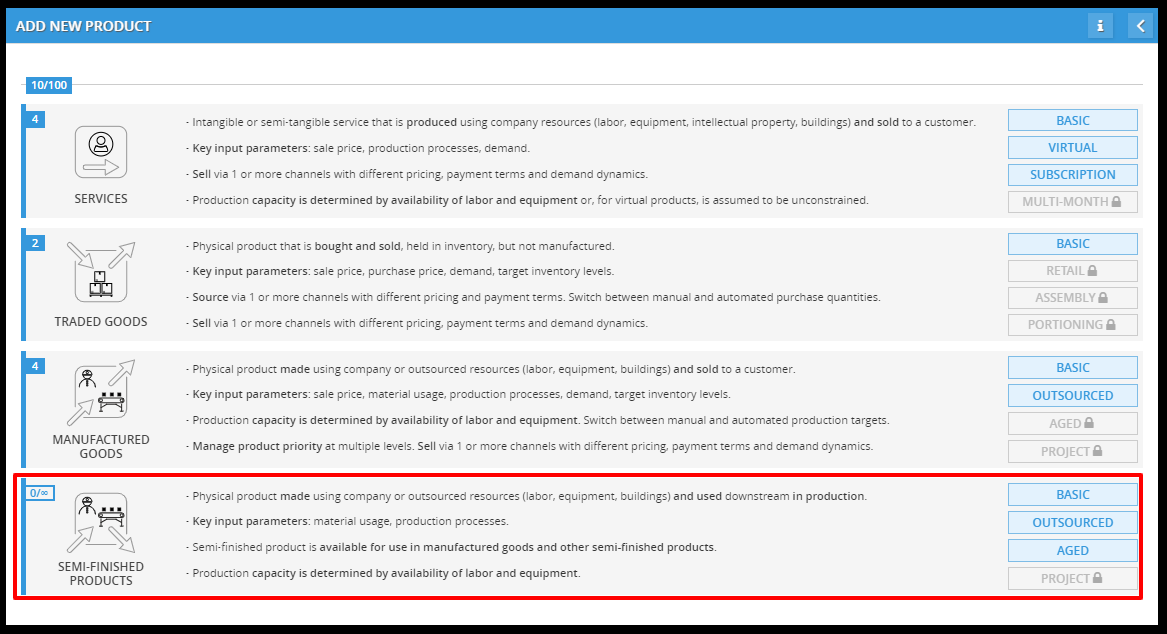

How to add an outsourced semi-finished products to your Product assumptions?

To add outsourced semi-finished products:

- Click PRODUCTS assumptions in the Business Concept section.

In some cases, you will encounter the Product List. Also, simply click Add New Product To Begin Working or Add New Product to begin working.

- In the Add New Product window, click Outsourced Semi-finished Products.

- Select subtype of product as a outsourced semi-finished products, Click OUTSOURCED.

WHAT IS A "OUTSOURCED SEMI-FINISHED PRODUCTS" PRODUCT TYPE IN DECISION CRITICAL?

Outsourced semi-finished products: This product type represents semi-finished products that are not manufactured in-house but rather obtained from a third-party supplier through an outsourcing agreement. These goods serve as building blocks for your final assembly processes.

Imagine you manufacture bicycles (finished products). You might outsource the production of some components, like the bicycle frames, from a specialized manufacturer. These outsourced frames would be considered "Outsourced Semi-Finished Products" in your production process.

- Enter the details of your semi-finished products:

- Product Name: Clearly identify the physical product you're adding (e.g., Cut and Sanded Wooden Boards).

- Main Unit of Measure: Specify the primary unit used to measure and track the quantity of your semi-finished product. This could be based on individual units (e.g., "Piece" for buttons), size (e.g., "Square Meter" for fabric), or other relevant measures depending on the type of semi-finished good you're producing.

- After you have entered all the details, simply click on "CREATE PRODUCT AND PROCEED TO PRODUCT CARD" to continue to the Product card.

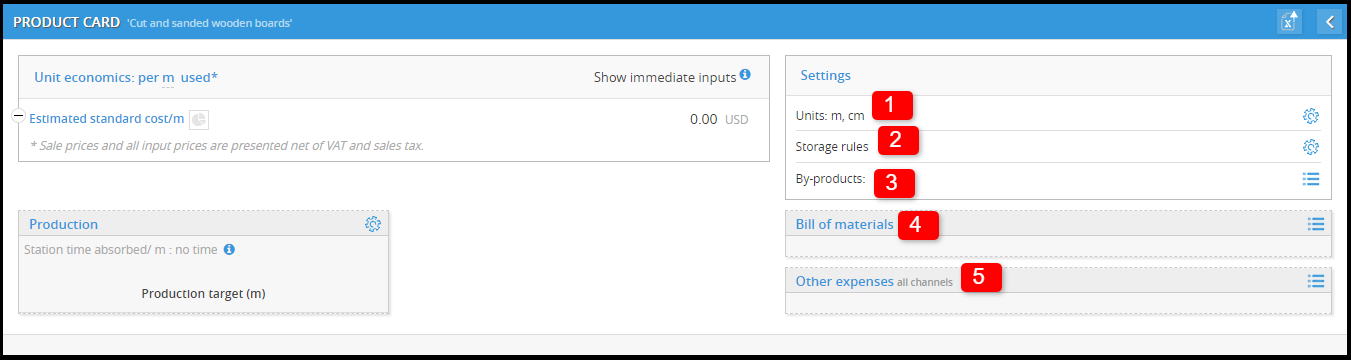

- Add your product settings to the product card.

Product card is a blueprint for each unique product in your company.

It serves as a centralized location within a scenario, where you define key assumptions about that product. For each product, the product card will be different based on the type of product.

Here are the essential settings you'll need for your semi-finished products:- Units: This specifies the primary unit of measure used to track your semi-finished good. This could be based on individual units (e.g., "Piece" for buttons), size (e.g., "Square Meter" for fabric), or other relevant measures depending on the type of product you're creating.

- Storage rules: This section allows you to define how you manage the inventory levels of your semi-finished.

- By-products: During the manufacturing process of your semi-finished good, your third-party manufacturer might generate by-products.

- Bill of Materials: This crucial section details all the raw materials, components, and sub-assemblies required to produce one unit of your semi-finished products.

- Product-driven Expenses: Define any additional costs associated with producing your semi-finished product beyond the raw material cost.

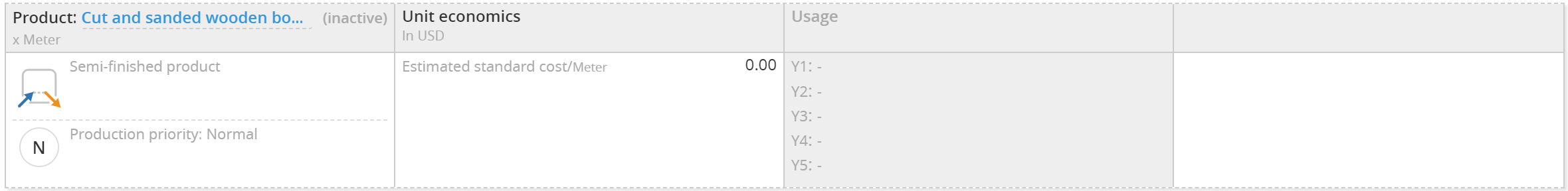

- After you have finished setting up the Product card, simply return to the Product list and you will be able to see the product you just created on the list.

Product card for outsourced semi-finished products

Here are the essential settings in product card you'll need for your outsourced semi-finished products:

Read the full instructions of each settings step-by-step below.

Read the full instructions of each settings step-by-step below.

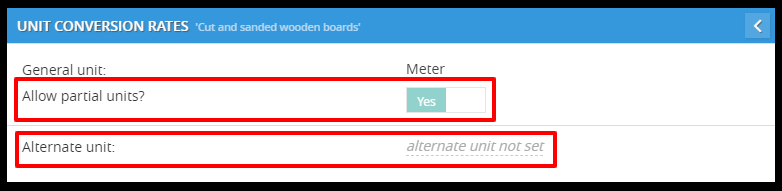

Units (unit conversion rates) settings for outsourced semi-finished products

In Unit conversion rates window:

- Allow partial units: This option, likely enabled by default (Yes), allows you to track and manage your semi-finished products in partial units This provides greater flexibility, especially when dealing with:

- Production processes: You might produce semi-finished products in batches that don't perfectly align with whole unit quantities (e.g., producing 12.5 meters of fabric).

- Internal consumption: Your final assembly processes might require consuming fractional units of semi-finished products (e.g., needing 1.75 meters of fabric for a specific product).

- Alternate unit: This feature allows you to define additional units for your product alongside the primary unit. You can then set a conversion rate (CR) for each alternate unit, indicating how many units of the alternate unit are equivalent to one unit of the general unit.

- To enable alternate unit: Click "alternate unit not set" > select the alternate unit > enter the conversion rate.

- To enable alternate unit: Click "alternate unit not set" > select the alternate unit > enter the conversion rate.

Here's a practical example:

Outsourced Semi-Finished Products with Unit Options

Let's consider a scenario where a third-party manufactures wooden boards as a outsourced semi-finished product for your furniture production. You can define two unit options in Decision Critical.Primary Unit: Meter (represents the length of a single wooden board) Alternative Unit: Square Meter (represents the area covered by a single board)

Conversion Rate: (Specify a conversion rate based on the board's width)

For example, if your wooden boards are 20 centimeters wide, the conversion rate would be:

- 1 Square Meter = 5 Meters (assuming the boards are long enough)

Explanation:

With this setup, you can track your inventory of wooden boards in both meters (length) and square meters (area). This provides flexibility for different needs within your production process:

- Length-based tracking: When purchasing raw materials (wood planks) or planning cuts for specific furniture pieces, tracking meters might be more convenient.

- Area-based tracking: When calculating material requirements for furniture pieces with specific surface areas, tracking square meters might be more efficient.

The conversion rate ensures clear communication between the two units. You can easily determine the required length of wooden boards (in meters) based on the needed surface area (in square meters) for your furniture projects.

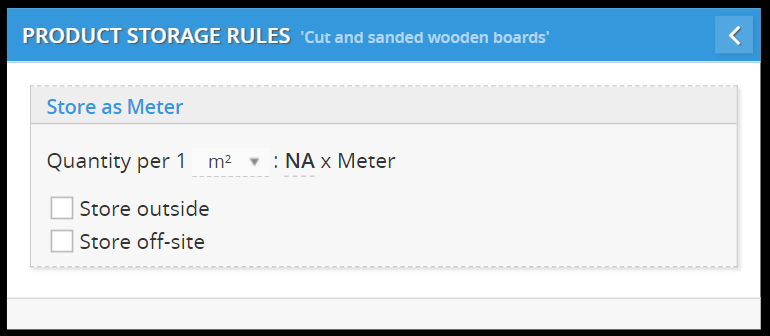

Storage rules settings for outsourced semi-finished products

Storage rules

- Storage Unit: "Store as (general unit)" indicates that products are stored and tracked in inventory using the general unit (e.g., meter). This aligns with how you would typically count buttons.

- Storage Efficiency: Quantity per Square Meter

- In "NA", You will need to enter a numerical value representing the maximum number of units that can be efficiently stored in a space of one square meter (m²).

- In "NA", You will need to enter a numerical value representing the maximum number of units that can be efficiently stored in a space of one square meter (m²).

-

Storage Options:

- Store outside: This option might be selected if products are typically stored in an external warehouse or storage facility. To enable this option, just checking its box.

- Store off-site: This could indicate that products are stored in a separate location from the main production facility. To enable this option, just checking its box.

- Storage Efficiency: Quantity per Square Meter

- Primary Unit: Meter (represents the length of a single wooden board)

- NA Field: Enter the number of boards you can efficiently stack per square meter.

By-products settings for outsourced semi-finished products

During the process of transforming raw materials into your semi-finished product, you might generate by-products. These are secondary or unintended materials produced alongside your main product.

Why Track By-products?

- Accurate Cost Calculation: By factoring in potential disposal costs, you get a more accurate picture of the overall production cost for your semi-finished product.

- Environmental Considerations: Understanding by-product generation allows you to explore ways to minimize waste or identify potential recycling or reuse opportunities.

- Inventory Management: If your by-product has value, tracking it as a separate inventory item helps manage its storage and potential sales.

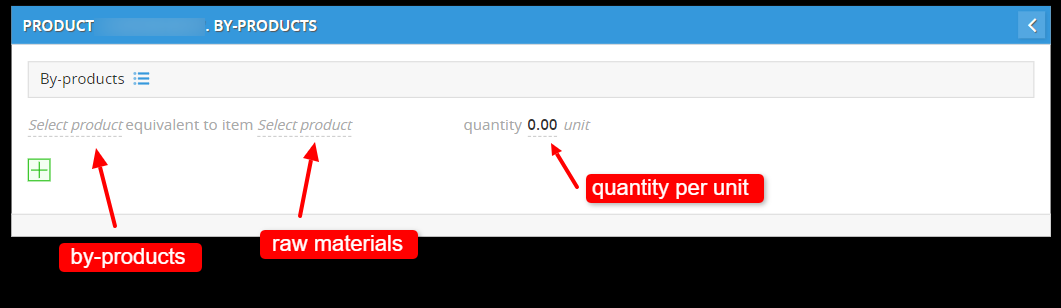

To add By-products

- Open By-products by clicking the list icon at the right side of By-products.

- In BY-PRODUCTS window, click "+ADD BY-PRODUCTS".

- Create the by-products by enter the name.

- Once you have added all the by-products, return back to BY-PRODUCTS window.

- Click "ADD NEW PRODUCT"

- Select by-product and raw materials that are equivalent for "(By-products) that equivalent to item (Raw materials)" then add its quantity with unit:

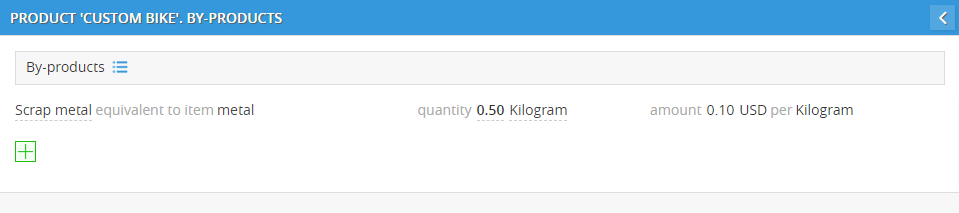

Here's a practical example:

If the manufactured process produced "Scrap metal" as the by-products and one scrap metal is equal 0.5 kilogram, you will need to enter:

- By-products (e.g., Scrap metal)

- Raw materials (e.g., Metal)

- Quantity per unit (e.g., 0.5 per KG)

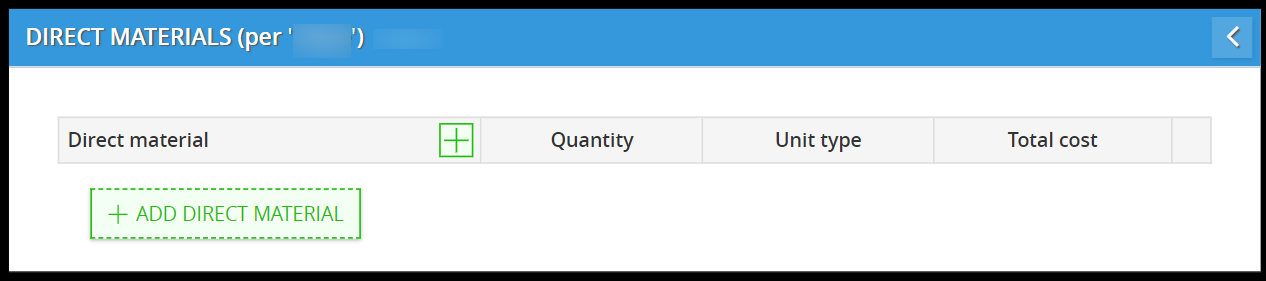

Bill of materials (BOM) settings for semi-finished products

Bill of materials

This allows you to define the raw materials and components directly used in manufacturing your product. This information is essential for accurate production planning, cost estimation, and inventory management.

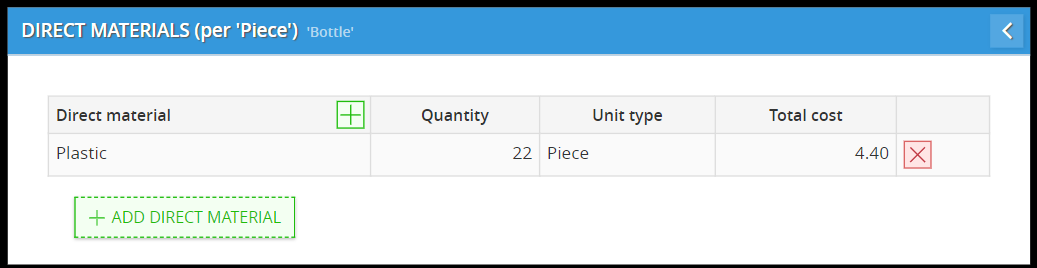

Key Elements in the Image:

- Direct Material: This column lists all the raw materials or components required to produce one unit of your finished good (you need to add the raw material manually.

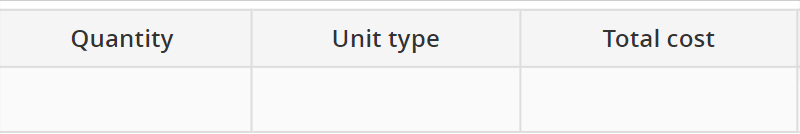

- Quantity: This column specifies the exact amount of each direct material needed to produce one unit of the product.

- Unit Type: This will defines the unit of measurement for each direct material. Examples might include grams, meters, liters, or units.

- Total Cost: This column will display the calculated total cost per unit for each direct material. (It will be automatically calculated based on your entered data and material cost information)

Adding Direct Materials:![]()

Add direct material button; "+ ADD DIRECT MATERIAL", allows you to add new lines to the table for each additional raw material or component required in your product's production process.

To add direct material:

- Open Bill of material by clicking the list icon at the right side of bill of material.

- In DIRECT MATERIALS, Click "+ ADD DIRECT MATERIAL" to add new direct material list.

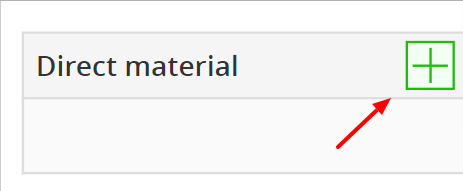

- Add raw material by clicking add button (+) near column "Direct material"

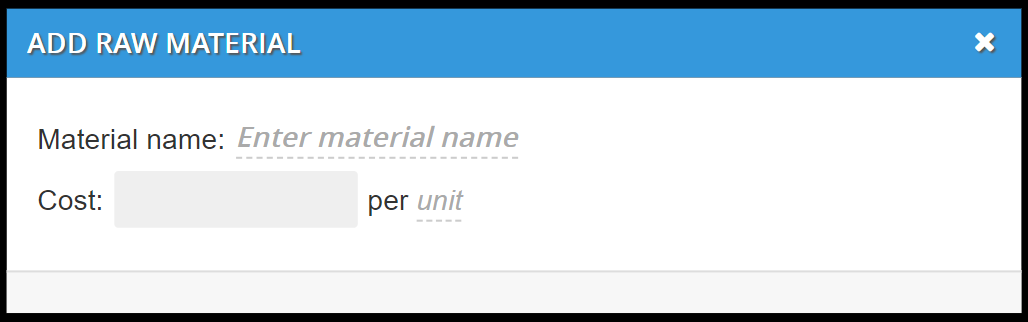

- In ADD RAW MATERIAL window, enter material's name in "Material name" (e.g., Plastic) then set its cost and unit (e.g., cost: 0.2, unit: gram).

- Once you finished entering raw material details, return back to DIRECT MATERIALS.

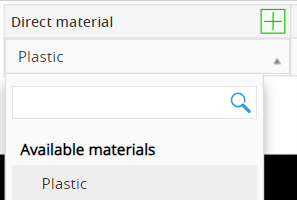

- Add the raw material to Direct Material by selecting it from the drop-down list.

- Then set the quantity and unit type of the direct material (Total cost will be automatically calculated).

- Once you have finished, you can close the window to save and return to product card. The newly added bill of materials will be on the list.

22 grams of plastic

When adding raw materials, you would enter

- Material name: Plastic

- Cost: 0.2

- Per: Gram

When adding these materials to the bill of material, you would enter:

- Direct Material: Plastic

- Quantity: 22

- Unit Type: Gram

- Total Cost: 4.40

- To delete the direct material, simply click on the delete button located on the right side of the list in DIRECT MATERIAL.

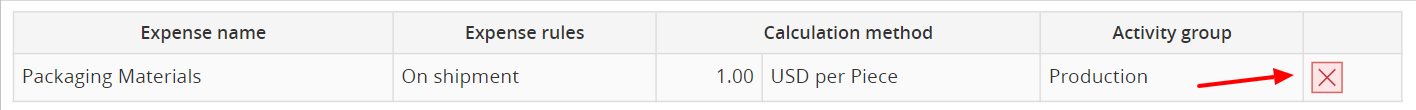

Other expenses (product-driven expenses for all channels) settings for semi-finished products

Other Expenses (Product-driven) for Semi-Finished Products:

This section allows you to define additional costs associated with producing your semi-finished good, beyond the raw material cost. These expenses are considered variable costs as they typically fluctuate based on the production volume of your semi-finished product.

Examples of Other Expenses:

- Machine Maintenance: Costs associated with maintaining the machinery used in the production process for your semi-finished product.

- Energy Costs: The cost of electricity or other power sources used to run the production machinery.

- Overhead Costs (Optional): You might allocate a portion of your facility overhead costs to the production of the semi-finished good. This can be a more complex calculation depending on your accounting practices.

To add product-driven expenses:

- Open PRODUCT-DRIVEN EXPENSES by clicking the list icon on the right side of Other expenses (all channels).

- In PRODUCT-DRIVEN EXPENSES window, click "+ ADD EXPENSES" to add new expenses. To add expenses:

- Enter expenses name (e.g., Energy Costs).

- Select a calculation method and set the number of expenses (e.g., $0.25 per meter of board.)

- Set the activity group. (find the meaning of each group below)

- Once you finished adding expenses, return back to PRODUCT-DRIVEN EXPENSES.

- Review the expenses you added, and then return to the product card. The newly added product-driven expenses will be listed.

Here's what you can specify for each expense:

- Expense Name: Give your expense a clear and descriptive name.

- Calculation Method: Choose how the expense is calculated:

- Per Unit Cost: This method assigns a fixed cost per unit of your product sold (e.g., "$2 USD per Piece").

- %(Percentage) of Amount Sold: This method calculates the expense as a percentage of the base wholesale cost per unit (e.g., "10% of Wholesale Cost for Packaging").

- Activity Group: Categorize the expense by its nature. Common categories include:

- General: Expenses that apply broadly to your business operations.

- Administrative: Administrative costs associated with managing your product.

- Selling: Costs related to marketing and selling your product.

- Production: Costs incurred during the production or delivery of your product.

- Non-Operating: Expenses not directly related to your product's core operations.

- By defining these product-driven expenses and utilizing expense rules, you gain a clear understanding of your overall costs per unit and their impact on your accounting practices.

- To delete the expenses, simply click on the delete button located on the right side of the list in PRODUCT-DRIVEN EXPENSES.

Can't find what you're looking for?

Chatting with our support team at decisioncritical.pro, or send a message to: